Section 179 Tax Deduction: The Hidden Benefit of Capital Equipment Purchases

Reading Time: 2 minutes read

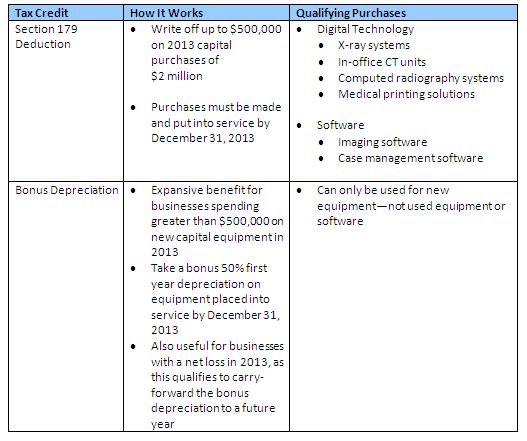

While the ROI benefits of incorporating radiography systems and medical printing solutions into your medical practice or clinic are well known, there are also a number of U.S. tax benefits you may be able to take advantage of as a small business owner.* Thanks to tax deductions passed by the federal government to help small businesses purchase capital equipment and spur economic growth, you are now able to write off a certain amount of your purchases at one time, rather than its depreciated value each year.

This year’s Section 179 deduction allows business owners to write off up to $500,000 on overall capital purchases (up to $2 million). However, this number is subject to change on an annual basis; in fact, it was supposed to decrease to just $25,000 in 2013, but was increased through the American Taxpayer Relief Act legislation. Despite this, the deduction amount is not guaranteed for next year, so you may want to look into purchasing your equipment before December 31 to ensure you lock in this deduction.

To highlight the potential deductions that may apply to you, I have created the following table:

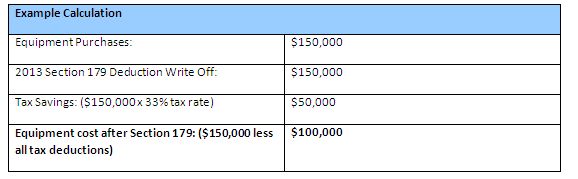

So, how do these deductions work? Let’s say you purchase $150,000 worth of qualified medical technology. Here’s one way the numbers may break down:

When it comes to this year’s tax code, time is of the essence. The maximum Section 179 deduction is expected to decrease to just $25,000 in 2014**, so you may want to consider taking advantage of this year’s deduction before the deadline passes.

* Before making any major purchase decisions, please speak to your business accountant or financial adviser.

** This amount is subject to change.

Pingback: Top 10 Everything Rad Posts of 2013 | Everything Rad